Do I Need Concealed Carry Insurance in Texas?

As a Texas LTC licensee, you’re legally permitted to carry a handgun—but does that mean you’re fully protected if you ever use force in self‑defense? Not necessarily. Texas allows permit less carry in most public settings if you’re at least 21 and meet federal/state legal eligibility. While having an LTC isn’t required to carry, many still opt to get one for benefits such as reciprocity with other states and smoother background checks.

Do I Need Concealed Carry Insurance in Texas?

Insurance is not required by Texas law. House Bill 3137 even prevents local governments from mandating liability insurance for gun owners at the municipal level. So as a licensee, you’re under no legal requirement to carry insurance.

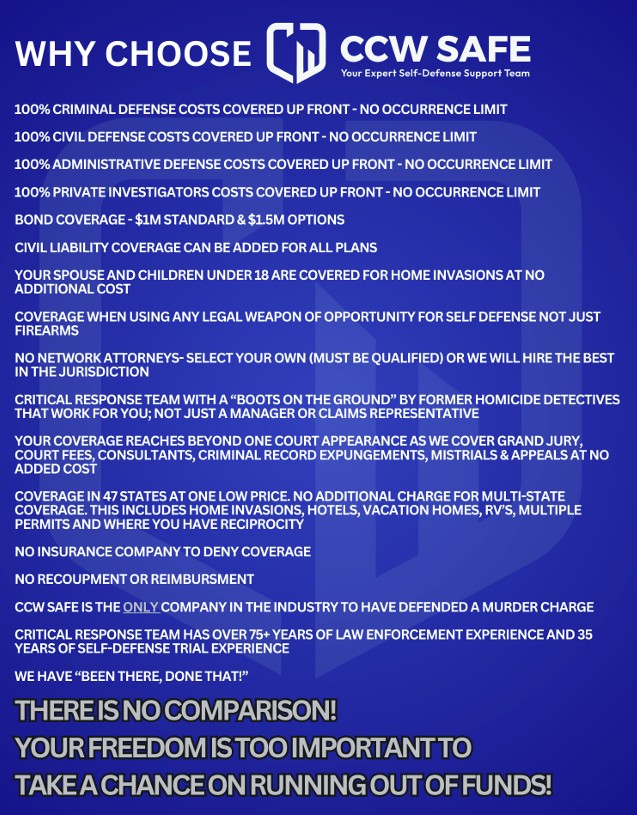

However, concealed carry insurance (often called self‑defense liability coverage) can provide critical legal defense and financial protection if you’re involved in a use‑of‑force incident. Such insurance typically covers attorney fees, civil lawsuits, and even bail or damages—supporting you through tough legal complications. Industry experts widely advise that every responsible gun owner should strongly consider coverage.

In short:

- Insurance is not mandatory under Texas statute.

- But it can offer peace of mind and real protection if you face criminal or civil claims after a shooting.

- Many LTC holders find that insurance adds value beyond the legal benefits of licensing—especially for visiting reciprocity states, or if you ever need legal representation quickly.

Bottom line: While it’s not required, concealed carry insurance is a smart consideration for LTC licensees wanting protection against potential legal and financial risks